The fintech sector in the Middle East is witnessing exponential growth, driven by a combination of regulatory support, rising digital adoption, and significant investments. As countries across the region diversify their economies and embrace digital transformation, fintech has emerged as a key enabler of innovation in sectors like banking, payments, wealth management, and insurance. With the market expected to grow significantly in the coming years, the Middle East is positioning itself as a global fintech hub.

This article explores the key trends shaping the future of fintech in the Middle East and their implications for the region’s economy, businesses, and consumers.

1. The Rise of Open Banking

Open banking is reshaping the financial services landscape in the Middle East, offering consumers more control over their financial data and enabling the development of innovative financial products.

a) Regulatory Push

Countries like the UAE, Saudi Arabia, and Bahrain have introduced open banking frameworks, encouraging collaboration between traditional banks and fintech startups. Bahrain was the first in the GCC to launch a comprehensive open banking regulatory framework, setting the stage for other countries to follow suit.

b) Enhanced Customer Experiences

Open banking allows fintech companies to create personalized financial services by securely accessing customer data from banks. This results in improved user experiences, such as aggregated financial dashboards, better budgeting tools, and seamless payment solutions.

Example: Tarabut Gateway, a Bahrain-based open banking platform, connects banks with fintechs across the GCC, fostering innovation and expanding financial inclusion.

2. Expansion of Digital Payments

The shift toward cashless economies is accelerating in the Middle East, with digital payments becoming a cornerstone of fintech innovation. The COVID-19 pandemic further catalyzed this trend, leading to widespread adoption of contactless payments and e-wallets.

a) Growth of Mobile Wallets

Mobile wallets such as STC Pay in Saudi Arabia, Payit in the UAE, and BenefitPay in Bahrain are rapidly gaining popularity. These platforms provide consumers with convenient and secure ways to make payments, transfer money, and manage finances.

b) Rise of Buy Now, Pay Later (BNPL)

The BNPL model is gaining traction among Middle Eastern consumers, particularly younger generations. Fintechs like Tabby and Tamara are leading this space, offering flexible payment solutions that allow customers to make purchases in installments without traditional credit checks.

Example: Tabby, a UAE-based BNPL provider, has expanded across the GCC, partnering with major retailers and e-commerce platforms to offer installment payment options.

3. Fintech for Financial Inclusion

One of the most significant opportunities for fintech in the Middle East lies in financial inclusion. With a substantial portion of the region’s population still unbanked or underbanked, fintech solutions are bridging the gap by providing access to financial services for underserved communities.

a) Digital Wallets and Microfinance

Fintech companies are using digital wallets and microfinance solutions to reach unbanked populations, particularly in rural areas. These services enable users to access savings accounts, microloans, and payment platforms without needing traditional bank accounts.

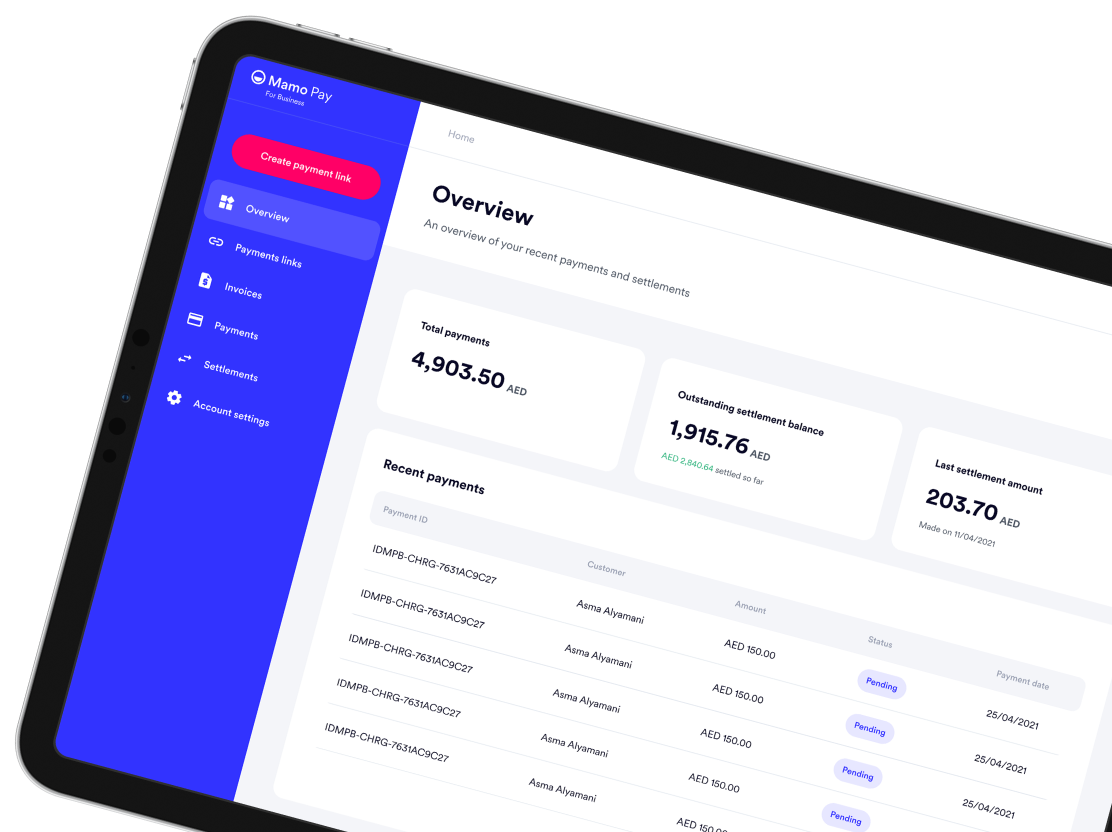

b) Focus on Migrant Workers

In countries like the UAE and Saudi Arabia, fintechs are addressing the financial needs of migrant workers by offering remittance services with lower fees and faster transaction times compared to traditional methods.

Example: Mamo Pay, a UAE-based fintech, focuses on simplifying peer-to-peer payments and remittances, providing accessible financial solutions for individuals and small businesses.

4. Blockchain and Cryptocurrency Adoption

The Middle East is emerging as a leader in blockchain and cryptocurrency adoption, with governments and private sectors leveraging these technologies for financial innovation.

a) Government Initiatives

Countries like the UAE and Saudi Arabia are at the forefront of blockchain adoption. The Dubai Blockchain Strategy aims to make Dubai the first city fully powered by blockchain by 2030, while Saudi Arabia’s Central Bank Digital Currency (CBDC) initiatives are exploring the potential of digital currencies.

b) Rise of Crypto Startups

Cryptocurrency exchanges and platforms are gaining traction, with fintech companies like Rain in Bahrain and BitOasis in the UAE leading the way. These platforms enable consumers to buy, sell, and trade cryptocurrencies securely.

c) Tokenization of Assets

Tokenization—converting real-world assets like real estate and commodities into digital tokens—is gaining momentum in the region. This innovation opens up new investment opportunities and enhances liquidity in traditional markets.

5. Artificial Intelligence (AI) and Big Data in Fintech

AI and big data are revolutionizing fintech by enabling companies to analyze vast amounts of financial data and deliver personalized, efficient services.

a) AI-Powered Chatbots and Advisors

AI-powered chatbots are transforming customer service in the financial sector, providing instant responses to queries and automating routine tasks. Robo-advisors are also becoming popular, offering automated investment advice based on individual financial goals and risk profiles.

b) Fraud Detection and Risk Management

AI and machine learning algorithms are being used to detect fraudulent transactions, assess credit risks, and enhance cybersecurity in financial services.

Example: The UAE’s Emirates NBD uses AI-driven fraud detection systems to monitor and prevent suspicious activities in real-time.

6. Growth of Islamic Fintech

Islamic fintech is a rapidly growing segment in the Middle East, catering to the demand for Shariah-compliant financial solutions. These solutions include Islamic banking, investment platforms, and peer-to-peer lending services.

a) Shariah-Compliant Investments

Islamic fintech platforms offer investment opportunities that comply with Shariah principles, avoiding industries like alcohol, gambling, and interest-based lending.

b) Digital Sukuk

Blockchain technology is being used to issue digital sukuk (Islamic bonds), making the process more transparent, efficient, and accessible to a global audience.

Example: Bahrain’s Central Bank is piloting blockchain-based sukuk issuance, demonstrating the potential of fintech in transforming Islamic finance.

7. Regulatory Sandboxes Driving Innovation

Regulatory sandboxes across the GCC are fostering fintech innovation by allowing startups to test their products in a controlled environment before full-scale deployment.

a) Bahrain’s Regulatory Sandbox

The Central Bank of Bahrain (CBB) introduced the region’s first regulatory sandbox, enabling fintech companies to trial their solutions while ensuring compliance with local regulations.

b) Saudi Fintech Sandbox

Saudi Arabia’s Fintech Saudi initiative includes a regulatory sandbox that supports startups developing solutions in payments, insurance, and wealth management.

c) UAE’s ADGM and DIFC Sandboxes

The Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) offer sandboxes that facilitate collaboration between fintechs, financial institutions, and regulators.

8. Cross-Border Fintech Collaboration

Cross-border collaboration is becoming increasingly important as GCC countries integrate their fintech ecosystems to create a unified regional market.

a) Unified Payment Systems

The introduction of GCC Net, a cross-border payment network, enables seamless transactions across member states, promoting trade and economic integration.

b) Regional Partnerships

Fintech companies are forming partnerships across GCC countries to expand their reach and enhance service offerings. These collaborations are driving innovation and fostering a more interconnected fintech ecosystem.

Image Courtesy Notice

At The Storiez, we value the efforts of photographers, artists, and content creators. The images featured in our articles are sourced from various news portals and online websites. We strive to ensure proper credit is given wherever possible. If you are the rightful owner of any image used here and would like to request its removal or correct attribution, please feel free to contact us. We respect intellectual property rights and aim to address concerns promptly.